Global differences in the digital vortex

Digital disruption is a global phenomenon, but that does not mean that it is evenly distributed across the globe. The Global Center for Digital Business Transformation, an IMD and Cisco initiative surveyed 953 executives across 12 countries about their attitudes and behaviors towards digital disruption. The research uncovered some interesting differences between executives in the so-called BRIC countries, Brazil, Russia, India, and China, and a basket of developed countries, consisting of Australia, Canada, France, Germany, Italy, Japan, the United States, and the United Kingdom.

The conflicted BRICs

As a group, executives from BRIC countries were significantly more optimistic about the impact of digital tools, technologies, and business models on their societies than executives from non-BRIC countries. As Figure 1 shows, more than 80% of executives from BRIC countries saw digital disruption as “a form of progress”, that “improves our quality of life”. The corresponding numbers for non-BRIC executives were 72% and 55% respectively. BRIC executives regarded digital disruption as a positive force that works to empower individuals and improve competitiveness. Non-BRIC executives were far more skeptical. They fretted about the effects of digital disruption on information security and sustainability.

![blobid0[1] - IMD Business School - IMD Business School](https://wwwtest.imd.org/wp-content/uploads/2022/08/blobid01.jpg)

Figure 1: BRIC executives are optimistic about the impact of digital disruption on society

While BRIC executives may be optimistic about the impact of digital on their societies, they feared its disruptive effect within their own industries. These executives estimated that 4.3 of the top 10 companies in their own industries by market share would be displaced by digital disruptors within the next five years. The corresponding number for non-BRIC executives was 3.5 (see Figure 2).

![blobid1[1] - IMD Business School - IMD Business School](https://wwwtest.imd.org/wp-content/uploads/2022/08/blobid11-1.jpg)

Figure 2: Number of the top 10 companies displaced by digital disruption in 5 years

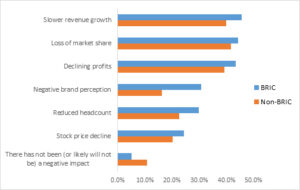

Further, the BRIC executives were significantly more concerned than their non-BRIC counterparts about the effect that digital disruption would have on their business performance. As Figure 3 illustrates, the negative impacts of digital disruption were estimated to be higher across many measures of performance, including revenue growth, market share, profitability, brand perception, headcount, and share price. By contrast twice as many non-BRIC executives felt that digital disruption would not have a negative effect on their business performance.

Figure 3: Assessment of the negative impact of digital disruption on business performance

The source of disruptive threats

Interestingly, while both BRIC and non-BRIC executives agreed that significant digital disruption was forthcoming, they disagreed about the source of these threats. The executives were asked about two potential sources of digital disruption: startups vs incumbents, and within their industry vs outside their industry. Both BRIC and non-BRIC executives saw the biggest threats coming from within their own industries, but they disagreed on the source (see Figure 4). BRIC executives regarded startups as their main threat, while non-BRIC executives were most concerned with existing incumbents.

These findings point to a growing culture of disruptive entrepreneurism within the BRIC countries, particularly in China and India. They also suggest a level of complacency among non-BRIC executives. These executives are mainly focused on incumbents from within their own industries – their traditional competitors. Whereas a significant amount of digital disruption has been shown to originate from non-traditional sources.

![blobid3[1] - IMD Business School - IMD Business School](https://wwwtest.imd.org/wp-content/uploads/2022/08/blobid31.jpg)

Figure 4: The sources of disruption: BRICs fear startups, while non-BRICs fear incumbents

Let’s look at the specific cases of China and Germany to illustrate these differences. As Figure 5 shows, over 70% of Chinese executives believe that startups would be the most likely digital disruptors, particularly from within their own industries. By contrast, executives in Germany believed that digital disruption would most likely arise from incumbent firms from within their industry.

![blobid4[1] - IMD Business School - IMD Business School](https://wwwtest.imd.org/wp-content/uploads/2022/08/blobid41.jpg)

Figure 5: Sources of digital disruption: China and Germany

Skills vs regulation

The executives were asked about how their organizations were responding to digital disruption, and the barriers that they faced. Both BRIC and non-BRIC executives regarded high capital investment requirements and complexity of business processes as major barriers (see Figure 6). In addition, executives in BRIC countries were concerned with a shortage of workers with the required skillsets to compete in a digitally disruptive world. This finding is consistent with research conducted by Aon, who found that BRIC countries were suffering from a shortage of digitally skilled workers. By contrast, non-BRIC executives were very concerned with regulatory requirements and roadblocks.

![blobid5[1] - IMD Business School - IMD Business School](https://wwwtest.imd.org/wp-content/uploads/2022/08/blobid51.jpg)

Figure 6: Barriers in response to digital disruption

BRIC executives recognize the digital threat

The research uncovered a striking difference in management attitudes towards digital disruption between BRIC and non-BRIC executives. Almost three-quarters of BRIC executives responded that digital disruption was a “board-level” or “CXO-level” concern at their companies, while only 48% of executives in non-BRIC countries claimed this was the case (see Figure 7).

![blobid6[1] - IMD Business School - IMD Business School](https://wwwtest.imd.org/wp-content/uploads/2022/08/blobid61.jpg)

Figure 7: Executive attitude towards digital disruption

Summary

The research findings suggest that executives from BRIC countries have a conflicted view of digital disruption. On the one hand, they are positive and optimistic about the changes that digital disruption can provide to their societies; yet, on the other hand, they are wary about its impact on their own companies and industries. They appear to be keenly aware of digital opportunities and threats, and are actively working to address them through executive action.

Non-BRIC executives, by contrast, seem less optimistic about, and less prepared for, digital disruption. They tend to see digital opportunities and threats through the traditional lens of competition. They acknowledge that digitization is occurring in their industries, but feel that they have time to change and adapt. Many of them are not ready to place digital disruption on the executive agenda.

Michael Wade is the Cisco Chair in Digital Business Transformation, and Professor of Innovation and Strategic Information Management at IMD. His interests lie at the intersection of strategy, innovation, and digital transformation.

He is Director of the Global Center for Digital Business Transformation and co-Director of IMD’s new Leading Digital Business Transformation program (LDBT) designed for business leaders and senior managers from all business areas who wish to develop a strategic roadmap for digital business transformation in their organizations.

He is also co-director of the Orchestrating Winning Performance Program (OWP).

Jialu Shan is a Research Associate at the Global Center for Digital Business Transformation.

Research Information & Knowledge Hub for additional information on IMD publications

Despite geopolitical upheavals that threaten global growth, companies continue to see business opportunities across borders. As leaders strategize how to position their operations amid war, trade disputes, disease outbreaks, and climate change, ha...

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications